Paytm IPO News: The digital payments leader is backed by Jack Ma’s Ant Group

Paytm’s Rs 18,300-crore share sale via initial public offering (IPO), the country’s biggest ever, is subscribed 56 per cent so far on its third and final day of issue, according to subscription data on the stock exchanges. Paytm IPO opened for subscription on Monday, November 8 and will close on November 10 – remaining open for investors for a period of three days.

On Wednesday, retail individual investors showed maximum interest as the portion reserved for them is fully subscribed by 1.37 times so far – the highest among the three groups of investors. The portion set aside for qualified institutional buyers or QIB is subscribed 0.54 times, while the portion reserved for non-institutional investors is subscribed 0.06 times, so far.

Paytm is selling shares in the price band of Rs 2,080- Rs 2,150 per share and retail investors can bid for a minimum of one lot of six shares up to a maximum of 15 lots. At the upper price band one lot of Paytm shares will cost Rs 12,900.

The IPO consists of a fresh issue of Rs 8,300 crore and an offer for sale (OFS) by existing shareholders worth Rs 10,000 crore. Investors such as Japan’s SoftBank, China’s Ant Group and Alibaba, and Elevation Capital are among the top investors who are diluting their stakes in the IPO.

Paytm’s IPO is likely to be the biggest in the country’s corporate history, breaking a record held by Coal India Ltd, which raised Rs 15,000 crore over a decade ago.

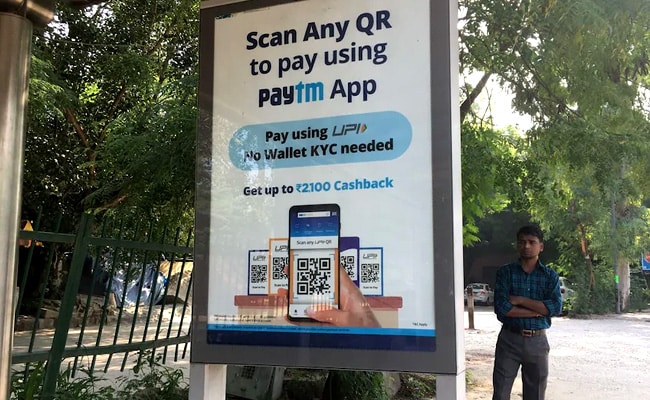

One 97 Communications – the country’s leading digital ecosystem for consumers and merchants, launched digital mobile payment platform ‘Paytm App’ in 2009. Paytm was first established to offer cashless payment services and mobile recharging. Now, it is the country’s largest payment platform. In 2016, Paytm’s use swelled further when a ban on high-value currency bank notes in India boosted digital payments.

”Paytm is expected to have a Market Cap of Rs 1.40 lakh crore post-listing. At this mcap, the issue is priced at about ~48 times Price/ Mcap ratio. This is extremely expensive. However, given a fancy for fintechs, the company could command a high valuation.

Given factors such as decline in revenue, losses over the last three years, market leadership status, strong growth in GMV, and positive sentiment due to marquee investors, investors with a higher risk appetite who wish to take exposure to a leading fintech company could consider investing in the issue,” SEBI-registered investment advisor INDmoney said in a report.